Other recent blogs

Let's talk

Reach out, we'd love to hear from you!

Did you know that 76% of U.S. insurance companies today are already leveraging next-gen breakthrough generative AI for at least one business function? Claims processing, customer service, and distribution are driving early adoption. More innovative claims management with AI has become mainstream.

The seismic impact of integrating AI in the insurance industry for claim processing and policy optimization is already evident. Here's the proof: Businesses that have successfully embraced integrated AI architectures for claim management and operations reported an 80% rise in faster claims processing and 50% lower underwriting costs. Is this an alarming sign for "Insurance 2030," indicating the impact of AI and its related technologies on the future of the insurance industry? If yes, will insurance agents be replaced with AI? Will AI affect the insurance industry?

In this blog, we will explore why businesses and their practice teams should pay attention to Agentic AI and the power of AI in Insurance claim processing, the key use cases they should prioritize, and how this technology is redefining existing opportunities.

Agentic AI for enhancing insurance claim processing automation

According to Statista, the global Artificial Intelligence market is expected to reach USD 243.72 billion by the end of 2025 and surge to USD 826.73 billion by 2030, growing at a CAGR of 27.67% and driving disruption across multiple industries. The insurance industry will have the most significant impact.

The industry is constantly under pressure to deliver faster and more accurate claims processing while keeping costs in check. For this goal, AI in insurance is indeed a catalyst for change, making the industry on the verge of a tech-driven shift. For insurance business leaders, the challenge is clear: improve cycle times, reduce leakage, and build a smarter ecosystem for scalable operations without disrupting daily demands.

AI in insurance, most particularly Agentic AI in claims processing, is already helping businesses unlock massive potential through intelligent automation that combines AI-powered decision-making, seamless integration, ethical data governance, and long-term scalability with continuous learning to handle complex, dynamic claims scenarios faster and more accurately.

Why insurers should pay attention to Agentic AI claim processing?

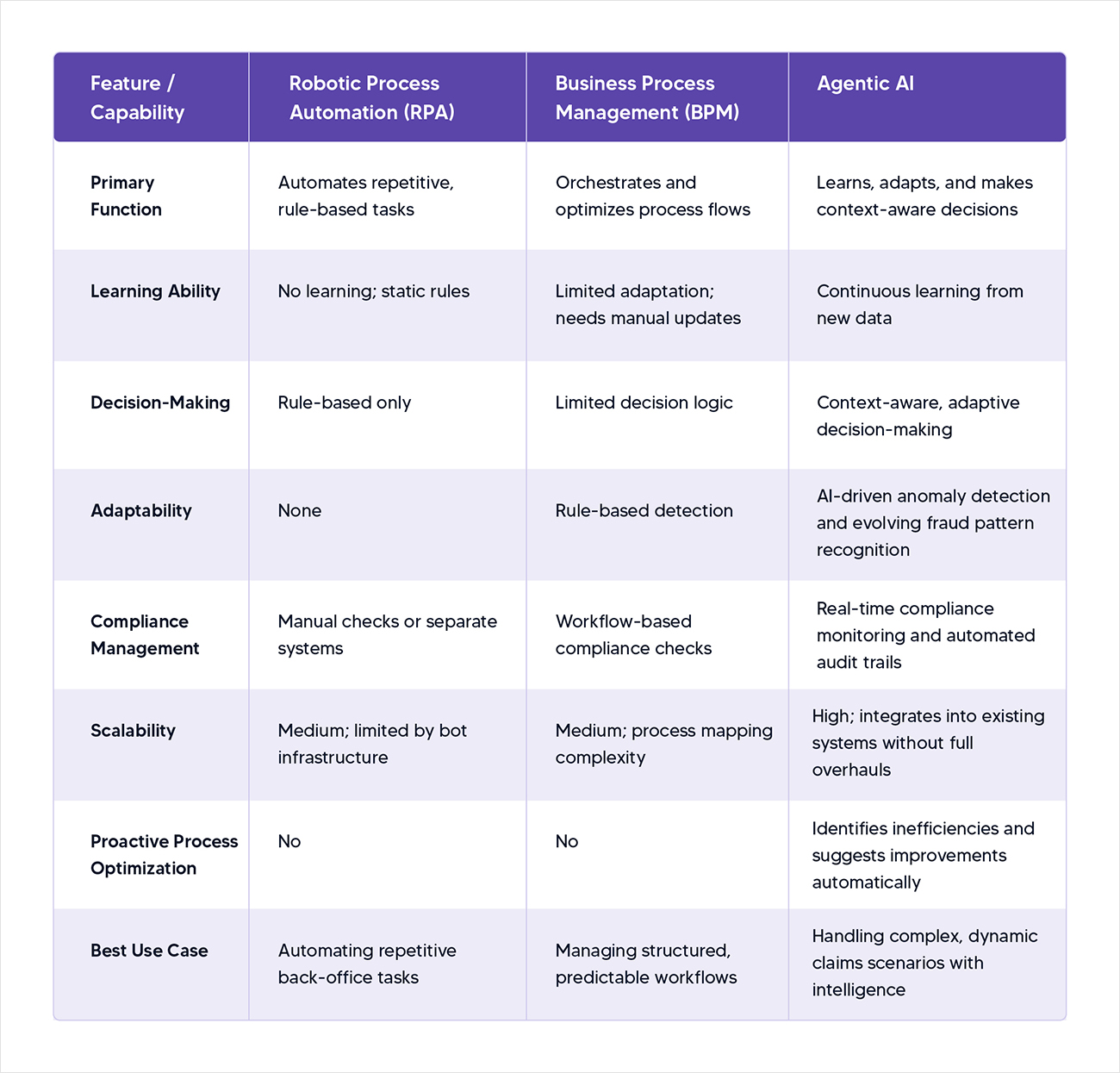

Practice leaders in insurance face a dual mandate: streamline operations to meet critical Key Performance Indicators (KPIs) like cycle time and leakage while managing the realities of day-to-day operations. These leaders are no strangers to automation, as many of them have already implemented RPA to handle repetitive tasks or BPM tools to orchestrate processes.

However, these solutions often lack flexibility when it comes to adapting to complex and dynamic scenarios. This is where Agentic AI stands out by combining continuous learning with autonomous decision-making, enabling systems to not only execute tasks but also make informed choices based on evolving data.

Here’s why Agentic AI is a game-changer for practice teams in the Insurance sector for AI insurance claims processing:

- Improved cycle time and reduced leakage: Agentic AI accelerates claims processing by intelligently routing tasks, prioritizing urgent cases, and minimizing errors that lead to financial leakage. For example, it can analyze historical claims data to predict which cases are likely to escalate, enabling proactive intervention.

- Scalability without overhauls: Unlike traditional automation, which often requires extensive reconfiguration to adapt to new processes, Agentic AI integrates seamlessly into existing enterprise systems. This allows practice teams to enhance operations without ripping out and replacing legacy infrastructure.

- Balancing innovation with operations: Practice leaders are tasked with executing change while keeping the lights on. Agentic AI’s ability to learn and adapt reduces the need for constant manual oversight, freeing teams to focus on strategic priorities.

- A natural evolution from RPA and BPM: For teams already familiar with automation, Agentic AI isn’t a distant concept—it’s the next logical step. It builds on the foundation of RPA and BPM by adding cognitive capabilities, making processes not just automated but intelligent.

By embedding decision-making agents into core workflows, Agentic AI empowers practice teams to build resilient and future-proof operations that align with the broader vision set by VPs and C-suite executives.

AI claims processing: Exploring key use cases of Agentic AI implementation for claim processing

While vice presidents set the strategic vision for adopting Agentic AI, practice teams translate that vision into reality. These teams—spanning operations, IT, and delivery—must identify practical, high-impact use cases that deliver measurable results. Here are four critical use cases where Agentic AI can transform claims processing for Tier 2 practice teams:

1. First Notice of Loss (FNOL) intake

The FNOL process is the entry point for claims, and it’s often bogged down by manual data entry and inconsistent reporting across channels (e.g., phone, email, apps). Agentic AI revolutionizes FNOL by:

- Handling multichannel inputs: Agents can process claims reported via voice, text, or digital forms, extracting relevant details in real time.

- Classifying claim types: Using natural language processing (NLP) and machine learning, Agentic AI categorizes claims (e.g., auto, property, liability) and assesses their complexity.

- Triggering workflows: Based on the claim type and severity, the system automatically initiates the appropriate workflow, such as assigning an adjuster or flagging for further investigation.

Practice leaders can integrate Agentic AI into enterprise systems, ensuring seamless data flow and reducing bottlenecks at the outset of the claims process. In short, Agentic AI reduces FNOL delays by automating data capture, classification, and workflow initiation—cutting intake time from hours to minutes.

2. Dynamic claim assignment

Assigning claims to the right adjusters or teams is a logistical challenge that requires coordination across IT, delivery, and operations. Agentic AI optimizes this process by:

- Analyzing workloads and expertise: Agents evaluate adjuster availability, expertise, and current caseload to assign claims efficiently.

- Adapting to real-time changes: If an adjuster is overloaded or a claim requires specialized knowledge, the system dynamically reassigns tasks to maintain service levels.

- Scaling across regions: For large insurers, Agentic AI ensures equitable distribution of claims across geographically dispersed teams.

Practice leaders play a critical role in defining the logic for these assignments, working closely with IT to embed AI-driven decision-making into operational workflows.

3. Fraud detection

Fraudulent claims are a persistent challenge, costing insurers billions annually. While VPs approve budgets for fraud prevention, practice teams are responsible for selecting and testing fraud detection models. Agentic AI enhances fraud detection by:

- Analyzing thousands of data points: Agents evaluate location, claimant history, voice tone (for call-based claims), and metadata to identify anomalies in real time.

- Running A/B testing: Practice teams can experiment with different fraud models, comparing their effectiveness to optimize detection rates without increasing false positives.

- Adapting to new patterns: Unlike static rule-based systems, Agentic AI learns from emerging fraud tactics, ensuring long-term effectiveness.

By empowering practice teams to fine-tune fraud detection, Agentic AI reduces leakage while maintaining customer trust.

4. Compliance and audit automation

Regulatory compliance is non-negotiable in insurance, but manual audits are time-consuming and prone to oversight. While VPs set policy direction, practice teams implement the logic to ensure adherence. Agentic AI streamlines this process by:

- Aligning with regulations: Agents monitor claims data against evolving regulatory requirements, flagging potential violations before they become issues.

- Automating audit trails: The system generates detailed, tamper-proof records of every decision, simplifying audits and reducing risk.

- Proactively mitigating risks: By analyzing historical audit findings, Agentic AI predicts areas of non-compliance and recommends corrective actions.

Practice teams can leverage these capabilities to build robust, automated compliance workflows that align with enterprise-wide policies.

But what differentiates Agentic AI from RPA and BPM for smoother AI Insurance Claims Processing

What sets Agentic AI apart from traditional automation tools like RPA and BPM? Well, there are three core differentiators that make Agentic AI uniquely suited for claims processing:

- Continuous learning and adaptation: Unlike RPA and BPM, which rely on static rules that require manual updates when processes or regulations change, Agentic AI continuously learns from new data. For instance, it can refine fraud detection algorithms by identifying emerging patterns or optimize claim routing based on real-time workload shifts, ensuring sustained accuracy and efficiency.

- Context-aware decision-making: While RPA excels at repetitive, rule-based tasks, it lacks the ability to handle complex scenarios requiring judgment. Agentic AI acts as an intelligent partner, analyzing multifaceted datasets—such as claimant history, policy details, and external factors—to make informed decisions, like prioritizing high-risk claims or flagging potential fraud.

- Proactive process optimization: Traditional automation executes predefined workflows, but Agentic AI goes further by identifying inefficiencies and suggesting improvements. For example, it can recommend adjustments to claim assignment logic based on historical performance or highlight compliance gaps before audits, enabling practice teams to stay ahead of challenges.

These capabilities allow Agentic AI to automate and intelligently enhance claims processing, delivering measurable improvements in cycle time, leakage reduction, and operational agility.

Here’s a quick comparison: RPA vs BPM vs Agentic AI in Claims Processing

Our perspective on AI claims processing to transform practice teams into strategic innovators

Agentic AI redefines the role of practice teams, positioning them as strategic innovators rather than mere executors of top-down mandates. By integrating AI-driven agents into claims processing, practice leaders gain the tools to design adaptive, data-driven workflows that align with enterprise goals. This empowers teams to experiment with new approaches—such as piloting advanced fraud models or streamlining FNOL processes—while delivering quick, measurable wins that build trust with leadership.

Crucially, Agentic AI balances innovation with practicality. It enables modernization without requiring costly system overhauls, making it a pragmatic choice for insurers facing budget constraints and high expectations. By focusing on high-impact use cases like FNOL, dynamic claim assignment, fraud detection, and compliance automation, practice teams can drive transformative change while maintaining operational stability. This dual focus positions Agentic AI as a bridge between today’s realities and tomorrow’s possibilities, empowering practice teams to lead the charge in redefining claims processing.

From claims to underwriting, AI is driving change—learn more in our blog on AI in Insurance Underwriting.

Read BlogConclusion

Agentic AI is revolutionizing claims processing by empowering practice teams to build smarter and more efficient operations. For insurance practice leaders, the technology offers a path to meet critical KPIs—faster cycle times, reduced leakage, and controlled costs—while navigating the complexities of daily operations.

At Kellton, we help businesses to focus on use cases like FNOL intake or dynamic claim assignment, fraud detection, and compliance automation to deliver tangible results that are perfectly aligned with strategic visions.

Unlike traditional automation, Agentic AI’s ability to learn continuously, make context-aware decisions, and proactively optimize processes positions it as a transformative force in insurance. As practice teams embrace this technology, they’re not just optimizing processes—they’re shaping the future of claims processing, one intelligent decision at a time.

Frequently Asked Questions (FAQs) on Agentic AI in Claims Processing

1. What is Agentic AI in insurance claims processing?

To many insurance providers, Agentic AI in insurance claims processing can be explained as an advanced automation approach that leverages intelligent AI-powered agents. Interestingly, these agents are capable of continuous learning, making context-aware decision-making, and seamlessly optimizing adaptive workflows to handle complex and dynamic claims faster than traditional systems.

2. How does Agentic AI improve claims processing speed and accuracy?

Agentic AI accelerates claims processing by automatically routing cases, prioritizing urgent claims, reducing errors, and adapting workflows in real time based on data insights, resulting in faster cycle times and fewer processing delays.

3. What are the top use cases of Agentic AI in claims management?

Key use cases include First Notice of Loss (FNOL) automation, dynamic claim assignment, AI-powered fraud detection, and automated compliance monitoring and audit trails.

4. How is Agentic AI different from RPA and BPM in claims processing?

Unlike RPA and BPM, which rely on static rules and predefined workflows, Agentic AI learns from new data, makes intelligent decisions in complex scenarios, and proactively optimizes processes without manual intervention.

5. Can Agentic AI help reduce insurance fraud?

Yes. Agentic AI detects anomalies by analyzing large volumes of data points such as claimant history, location, and behavioral cues, and it continuously adapts to identify emerging fraud patterns.

6. Does Agentic AI require replacing legacy insurance systems?

No. Agentic AI integrates with existing enterprise systems, enabling insurers to modernize claims processing without expensive infrastructure overhauls.